Posts

Truthfully promoting a check to possess cellular put can aid in reducing the possibility of the put’s getting refused. You’ll should follow such laws if you’re planning a personal view, an authorized take a look at otherwise a mobile deposit cashier’s take a look at. We include all the information you send out you that have equipment recognition technical and cellular banking study encoding. To suit your shelter, we never shop their passwords and/or consider deposit investigation and you will photographs in your mobile device.

Mobile view put twenty-four/7 | porno teens group porno pics milf

It’s not advised to put another person’s check out their account because when porno teens group porno pics milf your put a check, you’re promoting they and you will verifying you have the proper to receive the funds. Transferring someone else’s check up on your account was sensed deceptive pastime. For individuals who found a that is not made off to your, better routine is to have the look at supported because of the payee and then placed into their very own membership.

Remember for added security, constantly sign off totally once you end up with the Wells Fargo Mobile application from the looking for Sign off. You can observe the newest condition of your own deposit on the Membership Hobby to your compatible membership. To possess a much better experience, download the new Chase app for the iphone or Android.

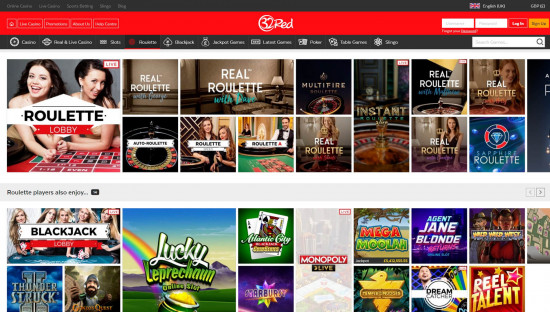

This will make Pay by Mobile phone the incorrect to possess high rollers and someone who would like to gamble along with spare transform. Investing by the Cell phone is a comparatively effortless style to grasp and you may even easier to make use of. How it works is you make a deposit to an online casino plus the fees is actually put in their mobile phone costs in the next commission period. This service membership requires little if any, options as well as the financing would be instantaneously for you personally in order to gamble having. To get started, make sure you features installed your own lender’s cellular software and so are signed into your bank account.

Twist the brand new Controls to find Book Incentives!

Third-people software that offer cellular look at deposit features may charge higher charge than just conventional banking companies. Much more banking institutions and you will borrowing unions are offering mobile cheque put because the a convenient method for consumers to incorporate currency on the profile. Very first, ensure that your financial otherwise borrowing union also offers cellular view deposit. Whether it does, your website can occasionally give an install link to the fresh bank’s cellular application. Down load the newest app to a smart phone having a camera—Android os, new iphone 4, and Screen gadgets are generally offered. Range from your financial’s website to make sure you get the fresh legitimate software rather than just an enthusiastic impostor.

The platform is so an easy task to browse, you could potentially set a bet that have one hand and you will enjoy poker to your most other. Immediately after an instant shop around, i made a decision to try the telephone costs deposit. Up to about three presses later, we were studying the kind of a future ICL matches having the equilibrium totally topped upwards.

Mobile look at deposit, labeled as remote put get within the financial terminology, makes you deposit inspections with your mobile phone’s camera rather than personally delivering these to a bank. You merely capture photographs from both parties of your own take a look at because of your own lender’s mobile application, and the put is processed electronically. The same as Fruit Pay, Google Pay doesn’t provide a primary look at put function however, aids integration which have some financial apps that do. Because of the hooking up a checking account, pages can be deposit inspections through their financial’s software and you will do purchases having fun with Google Spend. Fruit Shell out doesn’t personally help take a look at deposits within the application, but some financial apps integrated which have Apple Spend manage. Profiles can also be connect the checking account so you can Fruit Spend, fool around with their financial’s mobile application for consider places, and you can create their cash thanks to Fruit Pay.

If the financial otherwise borrowing connection offers mobile put nevertheless don’t possess its application, install they in your cellular telephone otherwise tablet from your own device’s application shop. That’s because the cellular cheque deposit feature inside apps essentially also provides a person-amicable experience, even for low-tech users. If you can work the digital camera in your mobile phone or tablet and also you know how to install an application, you might explore cellular cheque put. Customers are now able to upload a photograph of its look at using a good cellular app in order to put their cash. From the fashionable digital decades, financial has ended upwards becoming far more convenient than ever before.

You’ll discover a contact confirmation in the event the transaction is gone. You will additionally find it on your own directory of latest transactions in one business day. Include bucks to the eligible checking or bank account at any CVS, Walgreens or Duane Reade by the Walgreens area on the U.S. You might log in to the newest application and you will availability their account securely twenty four/7 by using the most advanced technology as well as Touch ID and you may single-play with shelter rules. As a result of the 3rd-group costs to have depositing via cell phone bill, very casinos have a fairly tight lowest deposit needs and certainly will perhaps not enables you to deposit £step 1. Originally a tough competitor away from Neteller, Skrill try obtained by their competitor’s parent organization within the 2015.

After that, it only takes a few minutes to your percentage as fully processed. Various other slow down explanation would getting away from not having verifications. For many who’ve deposited much — or a cost you wear’t normally deposit — the financial institution might need to contact you to be sure the brand new take a look at as well as your name. Immediately after termination, there’ll be 1 month in which to go back the brand new scanner. If not, you’re analyzed an additional $250 fee for you personally.

Ensure that the dollars count to the consider is correct just before you are taking images from it. Zimpler’s big advantage is founded on its self-reliance, giving both places and you can withdrawals. At the same time, it provides a different budgeting device to deal with gambling expenditures. But not, the accessibility and you will purchase fee matter is completely service provider-founded. The trick features is quick deals as well as the lack of bank account requirements, exactly like someone else on earth.

That it fundamentally concerns getting one to images of your front of your own view and one images of your back of your own look at — once you’ve supported it — to help you see on your search for deposit to your membership. Cash App, a well-known mobile payment service, and allows profiles to put checks thru its application. The procedure is simple and designed for pages who would like to create their profit in this a single software offering using and you can cryptocurrency features.

So it complimentary provider, that’s provided by most banking companies and you may borrowing from the bank unions, is available 24/7 and you will requires in just minutes to do on the mobile phone or tablet. In case your mobile view put is not operating and you believe you’ve done what you truthfully, there might be a problem with the mobile financial application. If so, you can contact the bank otherwise borrowing partnership to inquire should your application are off and you will, if that’s the case, whenever cellular look at deposit is generally restored. You can even find out about other put possibilities at the same time if you wish to add the view to your account At the earliest opportunity.